Crisis and Credit: Lessons from the 2008-2013 Recession

Conventional wisdom has it that crises are periods when the economy gets rid of less productive units at a faster pace, making room for the expansion of more productive companies and an increase in average productivity. But does this cleansing effect of recessions – as it is called by economists – prevail in times marked by increased financial restrictions?

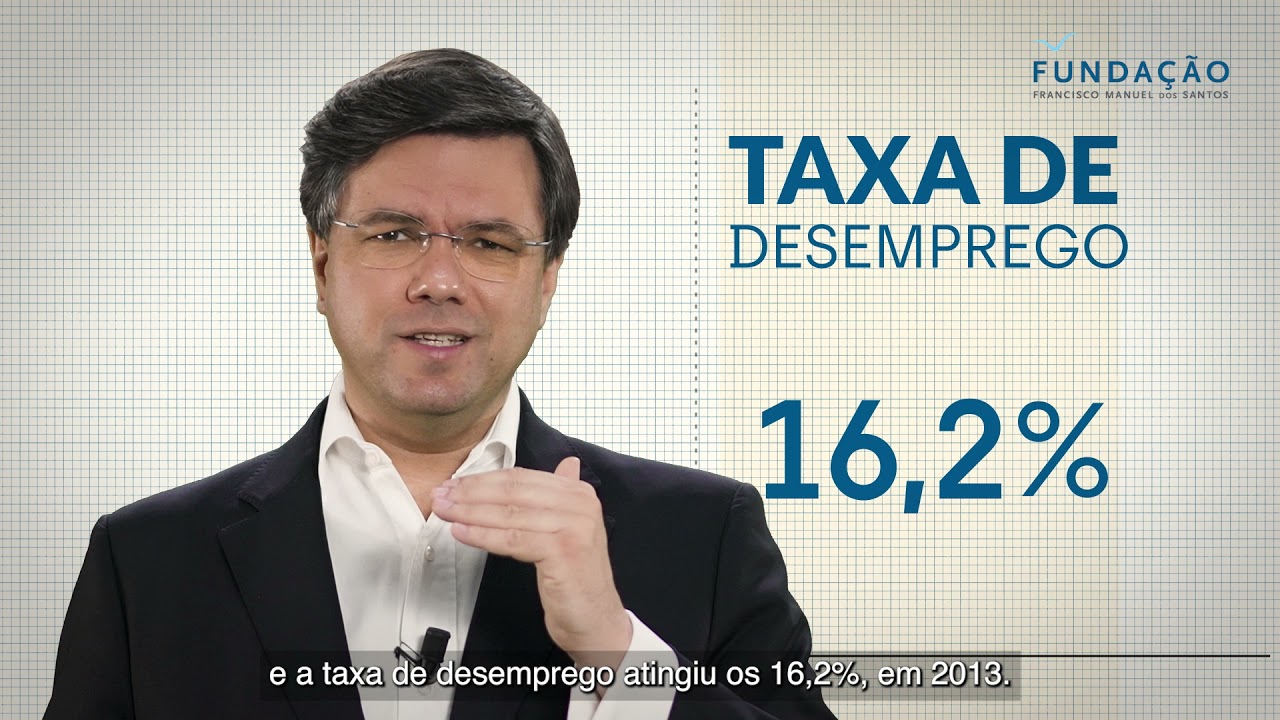

This study by Fundação Francisco Manuel dos Santos seeks to answer this question by looking at the case of Portugal during the 2008-2013 crisis, when companies faced severe restrictions on their access to credit as a result of the international financial crisis and high levels of sovereign debt. Considering the data on Portuguese companies operating in manufacturing and services in the period between 2004 and 2017, this study assesses whether Portuguese companies faced an additional risk to their business activities during the Great Recession (2008-2013), caused precisely by the restrictions imposed on access to credit. To this end, it looks at four key aspects:

- the functioning of market selection mechanisms, namely whether financial restrictions, which generate inefficiency, contributed to reversing the Schumpeterian cleansing effect attributed to recessions

- zombie companies – over-indebted mature companies unable to meet their financial commitments due to a persistent lack of profitability – and the factors that explain the recovery of these companies or, alternatively, their closure

- the impact of the legislative changes made to insolvency procedures in 2012

- the assessment of the impact of business dynamics on productivity growth before, during and after the Great Recession.

Through this study, FFMS seeks to raise awareness of the mechanisms through which the most acute economic crises affect business dynamics and, in this way, contribute to public and political debate on the formulation of more appropriate policies for periods such as the current economic crisis resulting from the Covid-19 pandemic.